VIEW BY TOPIC

- Finding Customers

- Business Systems

- Managing Employees

- Leadership

- Managing Money

Related Posts

Ready to Grow Your Business Fast?

Here’s How I Grew Five Businesses, and Eventually Sold One to a Fortune 500 Company.

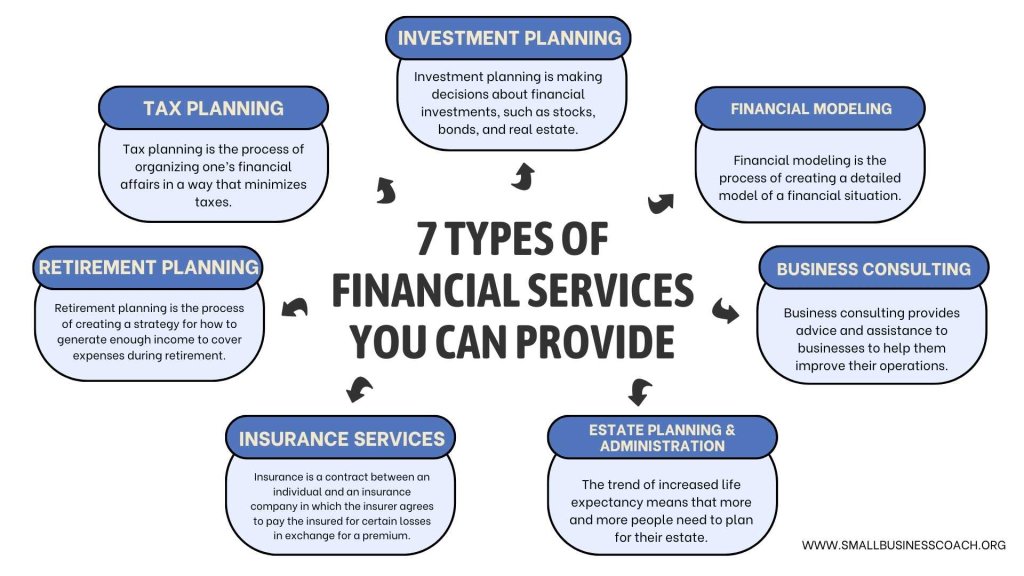

7 Types of Financial Services You Can Provide

Are you planning to start a financial services company? If so, you will need to determine which type of financial service to provide. Financial services are broadly defined as any service related to money management. This can include everything from giving loans and credit to investing and managing financial portfolios.

Financial companies are present in almost all countries and tend to be concentrated in cities and other major commercial centers. As a financial services provider, you can provide services to individuals, businesses, and other organizations.

This guide will discuss some of the best services you can offer as a financial advisor. So, let’s get started.

7 Types of Financial Services You Can Provide

Below is the list of financial services you can offer as a financial advisor:

1- Investment Planning

The first service on our list is investment planning. Investment planning is making decisions about financial investments, such as stocks, bonds, and real estate.

There are two main types of investment plans: conservative and aggressive. Conservative plans involve investing in safe, low-risk assets such as government bonds and cash equivalents. On the other hand, aggressive plans involve taking on more risk by investing in stocks and other high-yield securities.

As a financial advisor, you can help your clients choose the right mix of investments based on their goals, risk tolerance, and time horizon. In the case of stocks and trades, a bunch of ECN forex brokers, like IC Markets, RoboForex, OctaFX, LeoPrime, etc., are quite popular.

2- Tax Planning

Tax planning is the process of organizing one’s financial affairs in a way that minimizes taxes. It involves making decisions about how to invest, save, and spend money to minimize the amount of taxes owed.

You can provide tax planning and consulting services to individuals and businesses. This can involve helping them choose the right tax-advantaged investment accounts, such as 401(k)s and IRAs. You can also help them take advantage of tax breaks and deductions to minimize their tax liability.

Moreover, you can also help businesses with tax compliance. This can involve preparing and filing their tax returns and helping them resolve any tax-related issues.

Click here to learn about 5 common small business problems and how to avoid them.

3- Retirement Planning

Retirement planning is the process of creating a strategy for how to generate enough income to cover expenses during retirement. It involves estimating how much money will be needed in retirement and then making investment and saving decisions accordingly.

There are many different factors to consider when planning retirement, such as age, life expectancy, current income and expenses, desired lifestyle in retirement, and health status. As a retirement planning expert, you can help individuals and businesses create plans tailored to their specific needs and goals.

You can help your clients navigate these factors to make the best decisions for their retirement. In addition, you can also help them choose the right retirement account, such as a 401(k), IRA, or annuity.

4- Insurance Services

Insurance is a contract between an individual and an insurance company in which the insurer agrees to pay the insured for certain losses in exchange for a premium. Insurance can protect individuals and businesses from financial losses in accidents, injuries, deaths, or property damage.

There are many different types of insurance, such as life, health, auto, and home insurance. As a financial advisor, you can help your clients choose the right type and amount of insurance for their needs. In addition, you can also help them file insurance claims and resolve any issues that may arise.

5- Estate Planning & Administration

The trend of increased life expectancy means that more and more people need to plan for their estate. Estate planning is deciding what will happen to your money and property after you die.

Estate planning involves creating a will, trusts, and powers of attorney. It can also include deciding who will manage your affairs after you die. Choosing the right estate planning strategy can help to avoid probate, minimize taxes, and maximize the value of your estate.

As an estate planning expert, you can help individuals and businesses create plans tailored to their specific needs and goals. In addition, you can also help them with the administration of their estate after they die.

6- Business Consulting

Business consulting provides advice and assistance to businesses to help them improve their operations. Consulting services can range from strategic advice to helping with specific marketing or financial planning tasks.

Many startups and small businesses need help with various aspects of running their business. As a business consultant, you can provide the guidance and expertise they need to grow and succeed.

Moreover, you can help businesses with various issues, such as marketing, sales, customer service, human resources, and operations. Not only that, some companies are seeking financial planning and management. So, you can advise them in creating budgets, forecasting sales and expenses, and making investment decisions.

7- Financial Modeling

Financial modeling is the process of creating a detailed model of a financial situation. For example, economic models are often used to forecast future earnings, estimate the value of a company, or make investment decisions. Financial models are created using various financial statements, such as the balance sheet, income statement, and cash flow statement.

As a financial modeling expert, you can help businesses and individuals create accurate and realistic models of their financial situation. In addition, you can also help them use economic models to make informed decisions about their business or investment.

Summing Up Financial Services

As a financial advisor, you have a wide range of responsibilities. You can help individuals and businesses with various financial tasks, such as investing, retirement, insurance, estate planning, and business consulting. Financial advising is a complex and challenging field but can also be very rewarding. You can make a difference in your field with the right skills and knowledge.

Moreover, to get coaching for your small business, you can get in touch with Small Business Coach. Our team of experts can help you with various financial and business issues. Contact us today to learn more about our services!