VIEW BY TOPIC

- Finding Customers

- Business Systems

- Managing Employees

- Leadership

- Managing Money

Related Posts

Ready to Grow Your Business Fast?

Here’s How I Grew Five Businesses, and Eventually Sold One to a Fortune 500 Company.

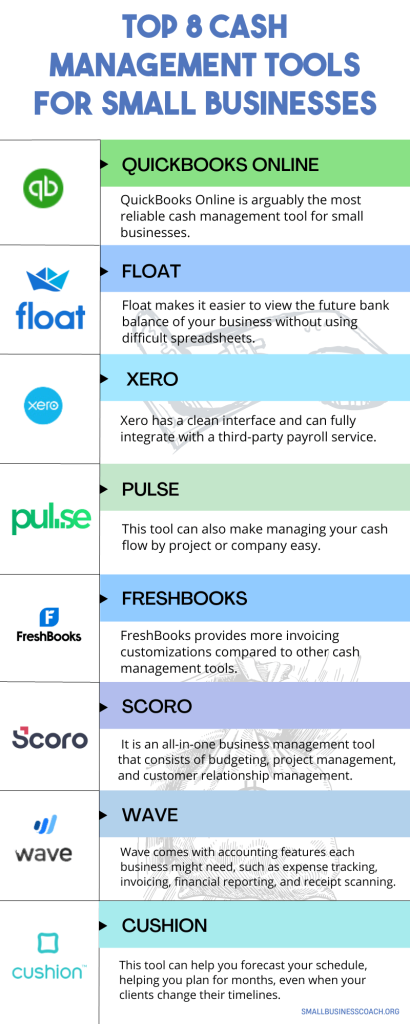

Top 8 Cash Management Tools For Small Businesses

It’s important to work with leading cash management tools to manage your small business. As cash management may either affect your business negatively or positively, choosing the ideal one for your business is a crucial decision. Before we list the top cash management tools, let’s understand first what cash management is.

Cash management refers to how you control and manage the cash flow in and out of your company or business. It is also how one collects the fund coming from clients and how business expenses are managed.

As a small business owner, it’s vital to understand that cash flow management determines the stability of your business. A healthy cash flow leads to timely collection and payments leading to business growth. Fortunately, you can use any online accounting services or other tools to manage your business cash flow.

Here are top-rated cash management tools for small businesses:

1. QuickBooks Online

QuickBooks Online is arguably the most reliable cash management tool for small businesses. While it can be daunting for business owners when the tax period knocks on the door, this tool makes managing your accounts easier. QuickBooks assist in tracking invoices, managing expenses, view profit, and loss ahead of tax filing. However, there’s a monthly fee that comes with QuickBooks. Nevertheless, you can try it for 30 days for free to know if it suits you.

2. Float

Float is a cash management tool that can be connected to other accounting tools such as Xero, FreeAgent, and QuickBooks. Float makes it easier to view the future bank balance of your business without using difficult spreadsheets. Float also features transaction notes, budget bars, and elegant reports so you can get full information on your finances. This is a visual and intuitive tool that provides clarity and confidence in managing your business funds.

3. Xero

If you’re looking for a simple cash management tool for your small business, Xero might be the best solution for you. Xero has a clean interface and can fully integrate with a third-party payroll service. When Xero is integrated with GoCardless and Stripe, businesses can collect payments from clients online.

Founded in 2006 in New Zealand, Xero currently has more than 2.7 million users globally. Xero is popular in New Zealand, the United Kingdom, and Australia. Xero has also been tremendously growing in the United States.

4. Pulse

Pulse is another cash management tool that helps you monitor your business’s cash flow. With Pulse, you can get several cash flow views daily, weekly, or monthly. This tool can also make managing your cash flow by project or company easy. It also features projection reports so you’ll be aware of how your money is moving.

Additionally, Pulse provides reports in numerous currencies. With Pulse, you can allow access to selected users involved with accounts. If you have QuickBooks, you can integrate it into your Pulse account for advanced accuracy of projections.

In short, Pulse enables you to come up with genius business decisions by allowing you a closer check at your expenses, income, and cash flow forecast. It also helps you determine when to hire additional staff or make more significant purchases via its cash flow management aspects.

5. FreshBooks

One of the most important accounting requirements for small businesses is invoicing. Thankfully, FreshBooks provides more invoicing customizations compared to other cash management tools. Its key function is to print, send, receive, and pay invoices. It can also offer basic bookkeeping requirements for small businesses. FreshBooks makes it easier for businesses to send proposals and invoices, collect customers’ retainers, request deposits, track time on projects, as well as receive payments.

6. Scoro

Scoro is a sturdy tool that takes care of all aspects of a business. It has a variety of services that include cash flow management. It is an all-in-one business management tool that consists of budgeting, project management, and customer relationship management. Its reliability is on another level according to its users.

Scoro brings each team member, project, report, and sales into one place. It’s undoubtedly a complete tool to help you be on top of everything. Scoro’s features include time management, business management, finances, projects and tasks, customization, client management, integrations, reporting and dashboards, and mobile app.

7. Wave

If you’re running a service-based small business sending simple invoices without the need to track inventory, Wave is the ideal accounting tool for you. For instance, most freelancers and other service-based businesses benefit from Wave’s free features that cover all accounting needs with ease. It can also provide its users with end-of-year accounts to prepare a business’ tax return.

Wave comes with accounting features each business might need, such as expense tracking, invoicing, financial reporting, and receipt scanning. Luckily, you can access these features online or via a mobile app. With Wave, bookkeeping, reporting features, and invoicing are free. However, payroll and customer payment processing are considered premium services that come at a cost.

8. Cushion

Cushion is a cash management tool designed for freelancers who need to stay on top of managing and planning their business. This tool can help you forecast your schedule, helping you plan for months, even when your clients change their timelines. With Cushion, you’re guaranteed a general overview of the whole year and be aware of availability and overbooking.

Cushion helps you realize your financial goals. It automatically adjusts your monthly goals throughout the year while separating what you need to earn from the desired profit. Likewise, Cushion helps you send and visually track invoices while allowing you a glimpse of patterns in your pay schedule. This tool can also be integrated with FreshBooks, Xero, among others.

Bonus Tool

Construction Tool –

Construction companies face unique challenges when it comes to managing their finances. To effectively handle the complexities of construction projects, specialized accounting software has become crucial.

Construction accounting software, such as Crewcost software, is designed specifically for the construction industry and offers a comprehensive set of features. These tools enable construction companies to track expenses, manage project budgets, handle payroll for construction crews, and generate accurate financial reports. By leveraging construction accounting software, companies can streamline their financial processes, ensure compliance with industry regulations, and gain better control over project costs. This software plays a vital role in improving efficiency, reducing errors, and providing real-time insights into the financial health of construction projects. Crewcost and similar solutions are essential for construction companies looking to optimize their financial management and achieve success in their projects.

Conclusion on Cash Management

As a small business owner, it’s essential to stay on top of the game for your business to grow, and for this to happen, you need to maintain accurate cash flow management. Cash flow management enables you to make wise decisions regarding your business. It provides you with accurate information on how your funds move in and out of your business. It’s believed that if you don’t track and manage your cash, you could end up making permanent mistakes that might harm your business.

Agreeably, you’re likely to find one suitable for your business with the tools mentioned here. These tools will help you track your cash and make better decisions for your business. Consider trying them out and see how your business benefits from them.