VIEW BY TOPIC

- Finding Customers

- Business Systems

- Managing Employees

- Leadership

- Managing Money

Related Posts

Ready to Grow Your Business Fast?

Here’s How I Grew Five Businesses, and Eventually Sold One to a Fortune 500 Company.

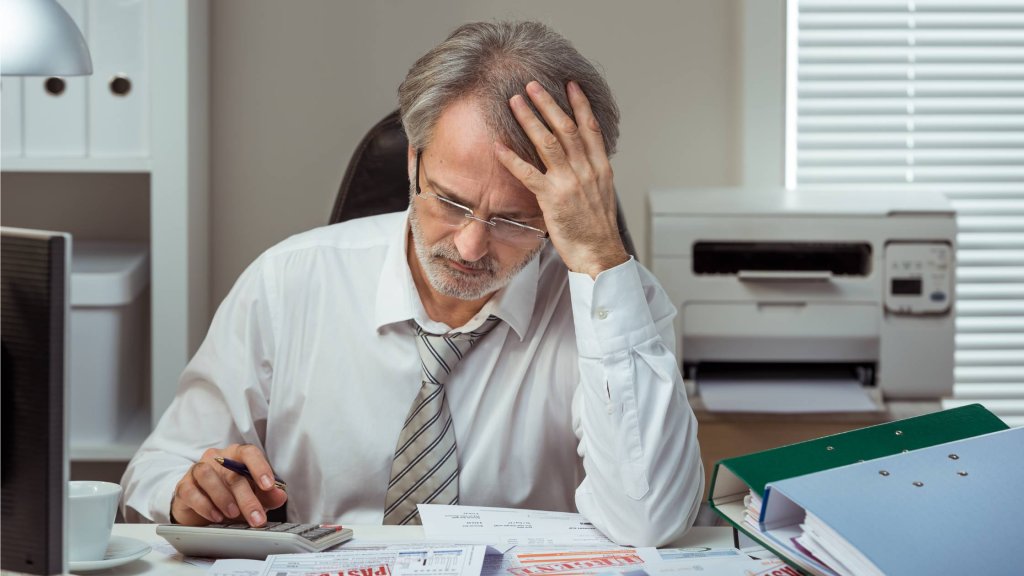

A Small Business Owner’s Guide to Bankruptcy

Bankruptcy can be a difficult and emotional decision for any business owner. However, for small business owners, it can be especially daunting as it can impact personal finances as well.

If you’re facing bankruptcy – or aren’t sure where your current financial situation will lead – you need to know your options.

What is Bankruptcy?

As a small business owner, you have to understand that bankruptcy can be a viable option when faced with overwhelming financial challenges.

Bankruptcy is a legal process that can provide relief for businesses struggling with debt and unable to pay their creditors. While it may seem like a difficult decision to make, filing can provide a fresh start for your business and allow you to move forward with a new financial strategy.

Common Types of Bankruptcy for Business Owners

There are two main types of bankruptcy that small businesses can file for: Chapter 7 and Chapter 11.

- Chapter 7, also known as liquidation bankruptcy, involves the sale of a business’s assets to pay off its debts. This type of bankruptcy is typically used for businesses that are unable to pay their creditors and do not have a viable plan for continuing operations. While Chapter 7 can provide relief from debt, it also means that the business will cease to exist.

“Chapter 7 may seem like the end of the road for a small business, but it can also be the beginning of a new journey towards financial freedom and a fresh start,” according to a bankruptcy lawyer. “It can open up new opportunities that you may have never considered before filing for bankruptcy.”

- Chapter 11, on the other hand, allows businesses to reorganize their debts and continue operating. This type of bankruptcy is often used by larger businesses that have the potential to recover but need some breathing room to restructure their finances. Chapter 11 can be a complex process, involving negotiations with creditors and the development of a detailed plan for financial recovery.

Understanding the Bankruptcy Process

Regardless of the type, the process typically involves filing a petition with the court, providing detailed financial information, and attending meetings with creditors. The court will appoint a trustee to oversee the proceedings and ensure that all parties are treated fairly.

In a Chapter 7 bankruptcy, the trustee will sell off the business’s assets and distribute the proceeds to creditors. In a Chapter 11 bankruptcy, the trustee will work with the business to develop a plan for restructuring its debts and operations. This plan must be approved by the court and creditors before it can be implemented.

The Impact of Bankruptcy on Personal Finances

It’s important to understand that filing for bankruptcy as a small business owner can also impact personal finances. If you’re a sole proprietor, for example, your personal assets may be considered when determining how to pay off your business’s debts.

Additionally, filing for bankruptcy can have an adverse influence on your credit score, making it more challenging to get loans or credit in the future. However, you also need to know that it is not the end of the road. With time and effort, it is possible to get your financial situation back in order.

Rebuilding

If you’ve filed for bankruptcy as a small business owner, there are steps you can take to rebuild your credit and get back on your feet. Here are a few strategies to consider:

- Develop a new financial plan<span style=”font-weight: 400;”>: After bankruptcy, it’s important to reassess your business’s financial situation and develop a new strategy for moving forward. This may involve restructuring your operations, reducing expenses, and finding new sources of revenue.

- Seek out professional help: Consider aligning with a credit counselor, financial advisor, or bankruptcy attorney to help you develop a plan for rebuilding your credit and improving your financial situation.

- Be vigilant about credit: After filing, it’s important to be diligent about monitoring your credit score and keeping up with payments. Consider obtaining a secured credit card or loan to help rebuild your credit.

- Build positive financial habits: Developing good financial habits, such as creating a budget and setting aside savings, can help you stay on track and avoid future financial challenges.

- Explore new revenue streams: After bankruptcy, it’s important to consider new revenue streams that can help you rebuild your finances. This may involve finding new products or services to offer, expanding your customer base, or exploring new markets.

- Build a support network: Rebuilding can be a challenging process, both financially and emotionally. It’s important to surround yourself with a positive and encouraging network of friends and professionals who can provide guidance and encouragement as you work to rebuild your finances. Consider joining a local small business support group or seeking out a mentor who has experience with bankruptcy and financial recovery.

Where Do You Go From Here?

As much as we’d love to give you a perfect prescription for addressing your financial troubles in this article, it’s simply not possible. However, the hope is that this article gives you some insights into how to think about bankruptcy.

Your next step is to speak with an attorney about your options.