VIEW BY TOPIC

- Finding Customers

- Business Systems

- Managing Employees

- Leadership

- Managing Money

Related Posts

Ready to Grow Your Business Fast?

Here’s How I Grew Five Businesses, and Eventually Sold One to a Fortune 500 Company.

Exit Strategy: Being in a Position of Strength

If you have done a good job of building a successful business, one day you should be able to sell it for a considerable sum of money. You have developed considerable “sweat equity” by working hard for your income.

It is wise to develop an “exit strategy” well in advance of your time to sell your business. Actually, you should have an exit strategy on the first day you are in business. Private Equity Groups will not make an investment in a business until they know how they are going to exit the business.

Your Business is a “401k Plan”

Since the majority of your wealth is invested in your business, you should begin to think about your business as a “401K” plan. No matter how long you have been in business, an exit strategy is an essential part of ensuring that your long-term financial interests stay in place. This will be true even though a number of scenarios could require you to adjust the date and manner in which you exit your business.

Keep Yourself and Your Business in a Position of Strength

You want to prepare for the right reasons, the right timing and the appropriate manner in which you depart your business in the future. Keep yourself in a position of strength. Your goal is to depart your business on your terms, not the terms of someone else! Consider the following two issues:

1. You should know the value of your business.

You should know how much you want to sell your business for in the future. Your exit strategy should be anchored by what can realistically be accomplished through a business sale at a later date. We recommend that business owners get an annual evaluation of their business. In the same way that a 401k plan investor gets an annual statement with the account balance, you should know the value of your hard work, and you should focus on building that value. Knowing this value may transform how you run your business and how you approach risks. Too many business owners subject their long term financial interests to unnecessary risks because they do not clearly understand the likely future return on investment.

2. Make sure you have an exit strategy that anticipates the unexpected.

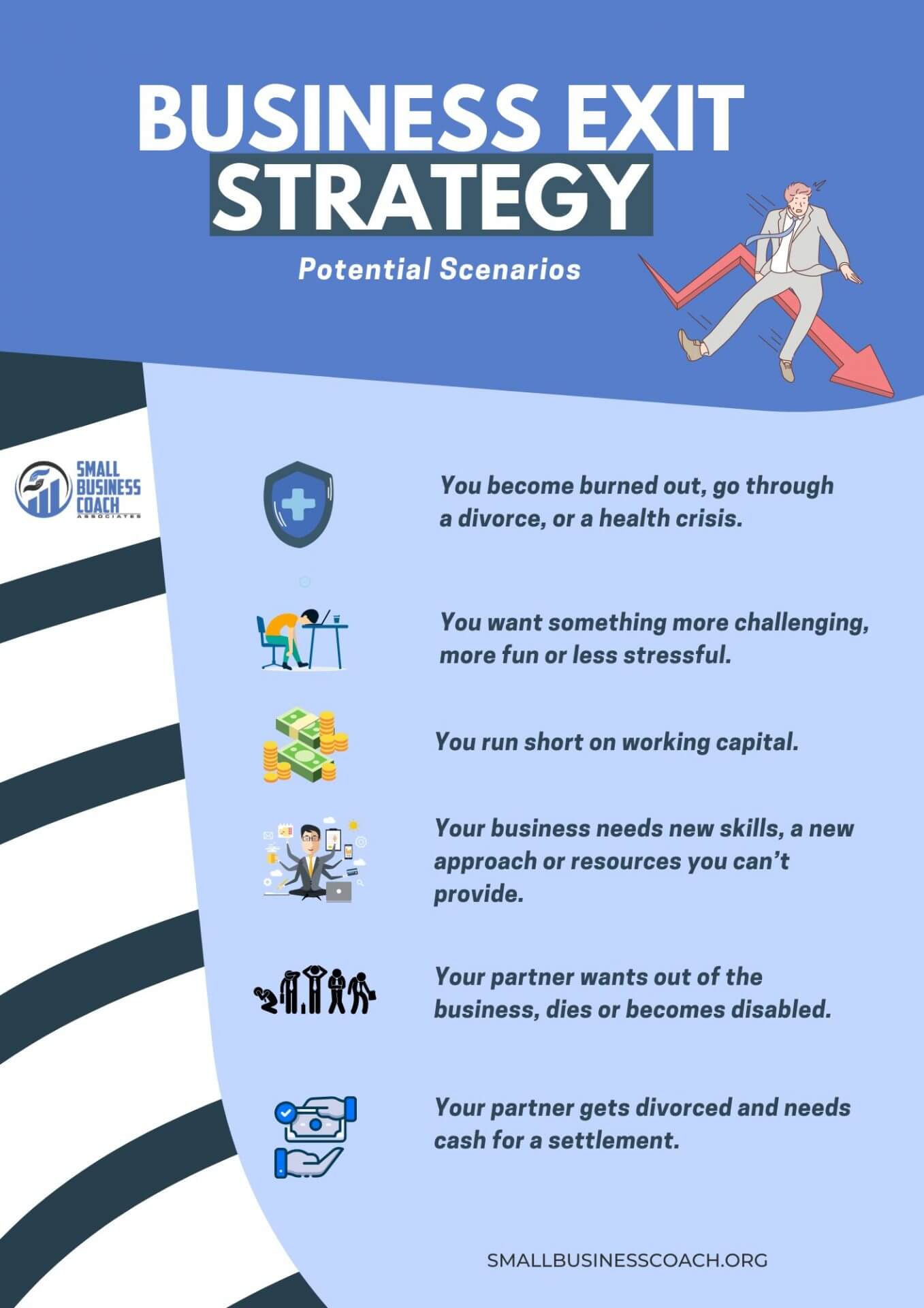

There is a strong likelihood that the timetable you have in mind for a future business sale may not come to pass right on schedule. It will likely happen sooner or later than your plan. The time spent preparing for “worst-case scenarios” will position you to save time, money, and legal problems. This time investment will help you to avoid stress, heartburn, the loss of your “401k” retirement plan. Below are some scenarios that could cause a major course correction.

Your Business Exit Strategy Should Consider Potential Scenarios

Do you have an exit strategy that addresses these potential scenarios?

• You become burned out, go through a divorce, or a health crisis.

• You want something more challenging, more fun or less stressful.

• You run short on working capital.

• Your business needs new skills, a new approach or resources you can’t provide.

• Your partner wants out of the business, dies or becomes disabled.

• Your partner gets divorced and needs cash for a settlement.

The fact is that very few business people want to spend time considering these negative situations, but the reality is that these things can happen, and you want to protect your retirement plan. Wise business owners make the time to address these issues.

Conclusion

A wise saying is that “you shall know the Truth, and the Truth shall set you free.” Spending the time now working on your business exit will help you plan for the unforeseen, and will allow you to build and protect your largest investment and asset; your “Business 401k plan.”

Questions about our small business coaching services?

Call us at 1-888-504-0777,

or