VIEW BY TOPIC

- Finding Customers

- Business Systems

- Managing Employees

- Leadership

- Managing Money

Related Posts

Ready to Grow Your Business Fast?

Here’s How I Grew Five Businesses, and Eventually Sold One to a Fortune 500 Company.

The Top Ten Ways to Improve Your Cash Flow

When the economy is in turmoil, it’s not just big businesses that need to worry about their cash flow. Smaller companies also struggle with keeping up with expenses when sales fall and they cannot afford any long-term debt obligations or future spending commitments for new equipment which could help them get through these tough times more easily than if left on an empty wallet alone

A business coach can provide you guidance on how best to manage your finances so as avoid going under before circumstances improve – all while helping ensure survival during difficult economic periods

Bootstrapping in Business

Small business owners, listen up! Bootstrapping is a term you need to know if you’re looking for ways to start and run your business on a tight budget. Bootstrapping (the act of starting and running a business with little capital) can be a positive or negative thing, depending on your perspective. On the plus side, bootstrapping can force you to be more mindful of your spending and help you stay afloat during tough times. On the other hand, being under-capitalized is one of the leading causes of business failure. If you’re thinking of bootstrapping your business, it’s important to be aware of the pros and cons before making a final decision.

The pros of bootstrapping:

- It can force you to be more mindful of your spending.

- It can help you stay afloat during tough times.

- It can make you more resourceful.

- It can help you better understand your customers and what they want/need.

The cons of bootstrapping:

- You may not have enough capital to get your business off the ground.

- You may have to work longer hours to make ends meet.

- You may have to forgo some luxuries, like hiring help or renting office space.

- You may put your personal credit at risk.

Covering Your Monthly Business Obligations

As a business owner, you know that even when you’re bringing in customers left and right, expenses can still get the best of you. You have weekly and monthly fixed expenses- think: payroll, loans, rent, utilities, phone bills, and advertising costs- as well as variable ones which adjust according to your sales. For example: if the business is booming and you’ve had to bring on extra hourly staff for the increased demand or paid more in credit card fees because of additional inventory ordered; those would be categorized under variable spending.

Sales may vary, and there can sometimes be a delay in receiving payment. If you have a business that only operates during certain seasons, one bad peak season could put you under for good. Usually, fixed expenses don’t wait for the cash to come flooding in from sales; they arrive on schedule whether or not we’re ready for them. I learned this the hard way when my former business saw a 400% increase in revenue from our off-peak season to our peak season. Needless to say, we had to pick up some extra tricks for managing cash flow!

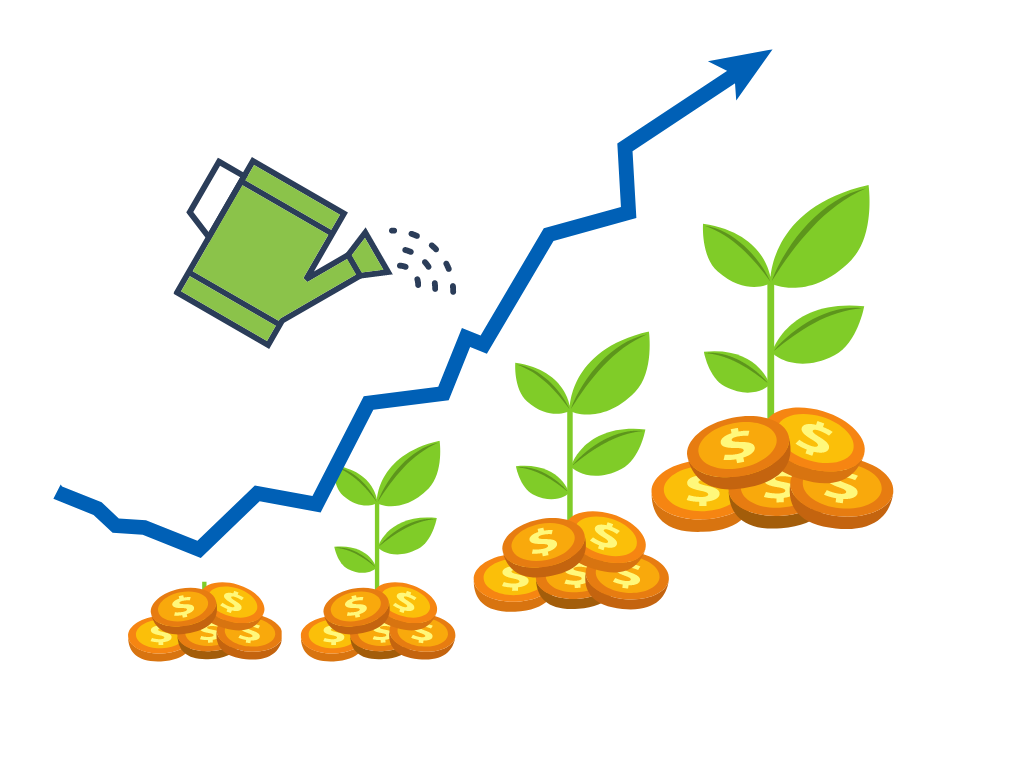

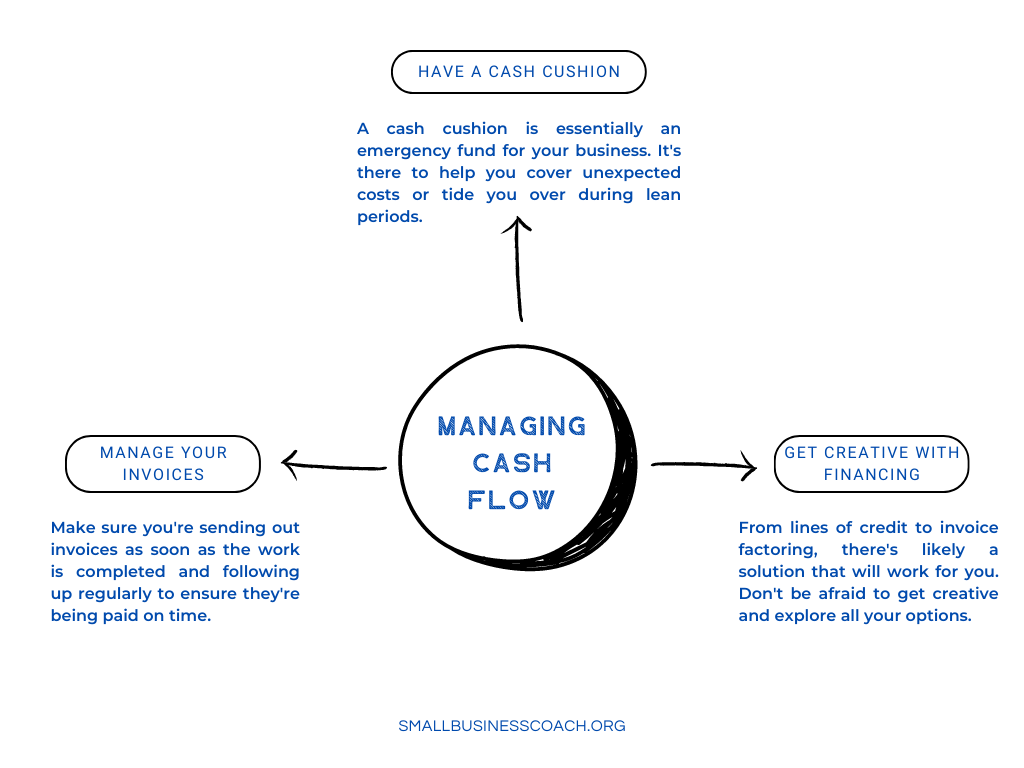

- Have a cash cushion – A cash cushion is essentially an emergency fund for your business. It’s there to help you cover unexpected costs or tide you over during lean periods. I recommend having 3-6 months’ worth of fixed expenses set aside in a separate account that you only dip into in case of an emergency.

- Manage your invoices – When you’re busy, it’s easy to let invoicing fall by the wayside. But staying on top of your invoicing is crucial to maintaining a healthy cash flow. Make sure you’re sending out invoices as soon as the work is completed and following up regularly to ensure they’re being paid on time.

- Get creative with financing – If you find yourself in a tight spot, there are a number of alternative financing options available to small businesses. From lines of credit to accounts receivable factoring, there’s likely a solution that will work for you. Don’t be afraid to get creative and explore all your options.

By following these tips, you can help ensure that your business is able to weather any storm. Fixed expenses are always going to be a part of doing business, but by being prepared and mindful of your cash flow, you can avoid any major bumps in the road.

| Pro-Tip: Grab 30 minutes on my calendar to ask any questions you have about business coaching. I’ve been a business coach (and business broker) for over 20 years. I also have a business coach of my own, so I know what successful coaching looks like on both sides of the table.~ Alan Melton, Small Business Coach Associates |

Getting Started With Improving Cash Flow

When you’re trying to improve your business’ cash flow, you need to predict two things: how much money you’ll bring in from sales this month, and how much your expenses will be (fixed and variable). If you expect to have more money coming in than going out, and you deliver on that prediction, you have positive cash flow. You always want to be cash-flow positive, but that can be tough when you’re just starting out and growing your business. You don’t want to overspend, especially if your sales aren’t growing as predicted.

Here is my top ten list of ways to improve your cash flow:

1. Implement cash flow budgeting and management.

Budgeting and managing your cash flow are crucial to the success of your business. By doing this monthly, you can keep track of your sales and expenses, and make changes accordingly. If your sales are falling short, cut back on your expenses. This will help ensure that your business stays afloat.

If your business is struggling to make ends meet, it’s time to take a close look at your cash flow. By creating a budget and tracking your spending, you can get a better handle on where your money is going. If you see that you’re spending more than you’re bringing in, it’s time to cut back on expenses. This will help you keep your business afloat.

2. Promote credit card and cash payment at the time of the order.

If you are selling a product or service, it is best to collect payment upfront by credit card or cash. This ensures that you will be paid for your work and prevents any issues with customers who may try to avoid paying after the product or service has been rendered. If a customer asks for terms, get their credit card number as security for payment. This way, you can be sure that you will receive payment for your work.

3. Improve payment terms on extended projects or services.

When you are working on an extended project or service, it is crucial that you change your payment terms. This means receiving a large deposit at the time of purchase, and then additional payments throughout the duration of the contract. Do not hand over the final product until after you have been paid completely. In doing this, you will guarantee that you are fairly compensated for your work.

4. Make a portion of your payroll variable.

A great method to lessen your overhead costs is to make a section of your payroll variable. What this means is that you only pay employees when you need them, and their salaries correlate with sales activity. When business is booming, you can hire independent contractors or seasonal workers to assist; however, during slower times their hours will be cut back or eliminated. Consequently, by making your payroll adjustable according to needs, you are able to decrease expenses and sync staffing requirements with business activity.

5. Discounts for timely payments.

You can often encourage customers to pay their invoices on time by offering a discount. For example, many businesses offer a 1-2% discount for payments made within 30 days. This not only incentivizes customers but also helps improve the business’s cash flow.

6. Negotiate extended payment cycles with vendors during peak seasons.

By reaching out to your vendors and negotiating extended payment cycles before your busy season, you can avoid any potential issues with late payments. If your vendor is not willing or able to be flexible, then it might be time to look for a new supplier that meets your needs better.

7. Do a credit check on new customers.

As a small business owner, it’s important to do a credit check on new customers. This will help you determine whether or not they are likely to pay their invoices on time. You can either do this yourself or hire a credit reporting agency to do it for you. Additionally, you may want to consider buying credit insurance, which will cover you in the event that a customer does not pay their invoice.

8. Track inventory and supplies.

In order to keep track of inventory and supplies, it is important to identify waste and make improvements to save money. This can be done by closely monitoring stock levels and implementing systems to optimize inventory management. By doing so, businesses can avoid over-ordering or running out of necessary items. Additionally, reducing waste can cut down on costs associated with storage and disposal.

Another way to save money is by improving the organization and storage of inventory. This can minimize the amount of time needed to locate items and make it easier to keep track of stock levels. Additionally, well-organized inventory can help businesses avoid damage or loss of valuable supplies. By taking these steps, businesses can improve their inventory management and save money in the long run.

| Pro-Tip: Grab 30 minutes on my calendar to ask any questions you have about business coaching. I’ve been a business coach (and business broker) for over 20 years. I also have a business coach of my own, so I know what successful coaching looks like on both sides of the table.~ Alan Melton, Small Business Coach Associates |

9. Shorten product or service cycle times.

If you can find ways to shorten the product or service cycle time, you’ll get paid faster. This could involve improving your manufacturing process, being more efficient in your delivery, or finding ways to streamline your operations. By doing this, you can improve your cash flow and keep your business running smoothly. In order for it to make sense, you could add: If you are a business owner it can be difficult to devote time to all of the different tasks required of you. Having online business banking solutions can help streamline your banking needs and save you a significant amount of time throughout the week. Online banking allows for payments, money transfers, balance checks, statement reviews, and many other services so that you don’t have to wait in long lines or drive around town trying to pay bills.

10. Have a backup plan and emergency strategies.

A backup plan is essential in preparing for the unknown. This could include having cash on hand, obtaining a line of credit from your bank, or keeping some low-interest credit cards with zero balance.

Coaching Client Adds $176,000 in Cash Flow

We were recently working with a client that had a severe cash-flow shortage. We identified seven areas of improvement that added $176,000 to his bottom line and dramatically improved his cash flow in 30 days. Although his cash flow had been poor for ten years, we were able to solve his problem in three meetings with the owner and his staff!

The client was amazed at how quickly we were able to turn around his cash flow shortage. He’d been struggling for years, but with our help, he was able to add $176,000 to his bottom line in just 30 days! We identified seven areas of improvement and worked closely with the owner and his staff to implement them. This was a huge success story and we’re so proud to have been able to help!

Conclusion

A wise saying is “you get what you focus on.” Cash flow management is important to keeping your business running smoothly and stressed-free. By investing some time each month in cash flow management, you can ensure that your business has the cash it needs to keep growing and seizing opportunities as they come. Having a handle on your cash flow will make you “The Cash King” and help you lead your business to success.

Questions about our small business coaching services?